Effective budgeting is essential for achieving financial wellness in an increasingly digital world. As financial technology continues to evolve, the best budgeting apps in 2025 offer innovative features, AI-powered insights, and seamless user experiences to help users track their income, manage expenses, and build better money habits. This article explores the top-rated personal finance tools and budgeting solutions that stand out in the current year.

Why Use a Budgeting App?

Budgeting apps have become indispensable for modern money management. They help users:

Monitor spending in real time

Create and maintain financial goals

Categorize expenses automatically

Link bank accounts for transaction tracking

Generate spending and savings reports

Receive alerts and financial tips

The best budgeting apps not only simplify your financial life but also provide personalized insights that guide smarter decisions.

Key Features to Look for in the Best Budgeting Apps

To determine the best budgeting apps in 2025, several key features were considered:

Bank syncing capabilities: Apps that connect securely with bank accounts and credit cards for real-time updates

AI-powered financial insights: Smart suggestions and data visualizations based on user behavior

Goal tracking tools: Features that help set and track short and long-term financial goals

Expense categorization: Automatic tagging of spending by category

User-friendly design: Intuitive interfaces that encourage consistent use

Security standards: Encryption and multi-factor authentication

Cross-platform compatibility: Availability on iOS, Android, web, and desktop

Top 12 Best Budgeting Apps in 2025

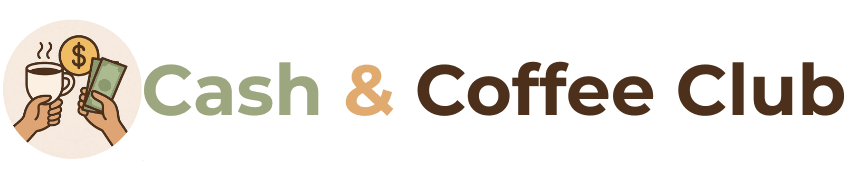

1. YNAB (You Need a Budget)

YNAB Budget App remains one of the best budgeting apps in 2025 thanks to its zero-based budgeting philosophy. It helps users assign every dollar a job and proactively manage their finances.

Highlights:

Powerful goal tracking

Educational resources

Detailed reports and projections

High user satisfaction

A reliable budget planner is essential for anyone aiming to take control of their personal finances. In 2025, the most effective tools emphasize proactive budgeting, allowing users to plan ahead, allocate funds strategically, and avoid unnecessary debt. Whether you’re managing household expenses or saving for long-term goals, using an advanced expense management app can provide clarity, reduce stress, and help you stay on track with your financial objectives.

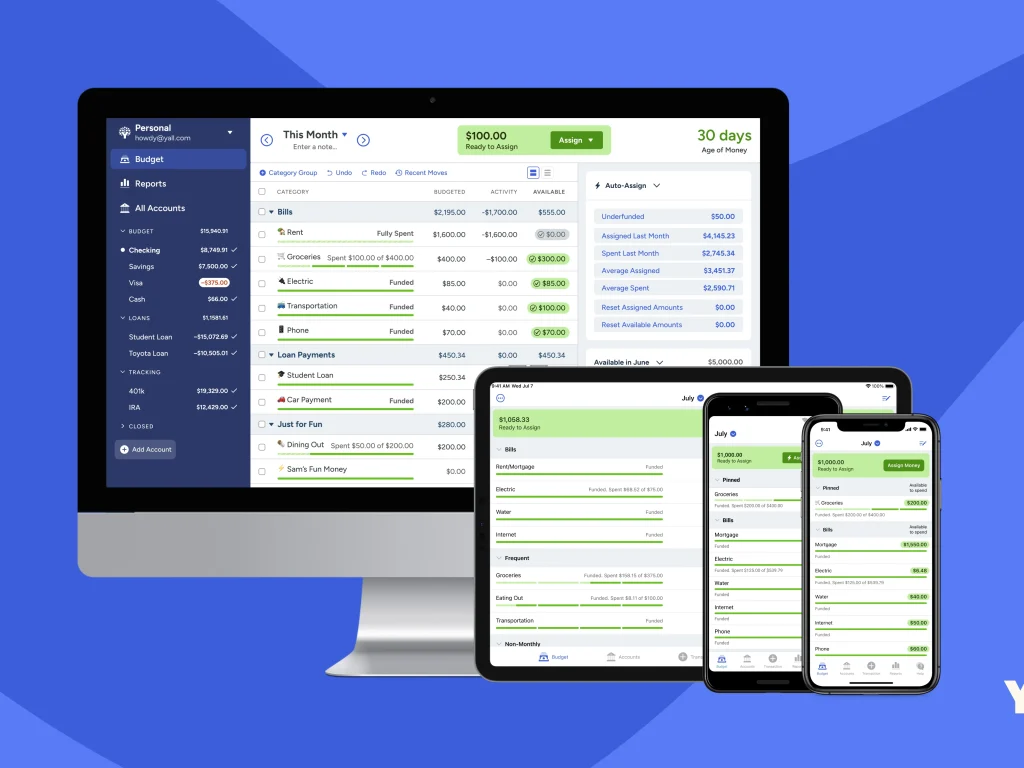

2. Mint by Intuit

Mint continues to be a top choice among free budgeting apps. With automatic bank syncing, customizable budgets, and bill tracking, Mint offers a comprehensive snapshot of personal finances.

Highlights:

Free to use

Credit score monitoring

Custom alerts

Cash flow forecasting

In today’s digital age, a smart financial tracker can make all the difference in managing your income and expenses effectively. A reliable personal finance manager not only provides insights into your spending habits but also helps you set realistic goals and stay accountable.

With the rise of online budgeting tools, it’s now easier than ever to access your financial data anytime, anywhere, and make informed decisions to improve your overall financial health.

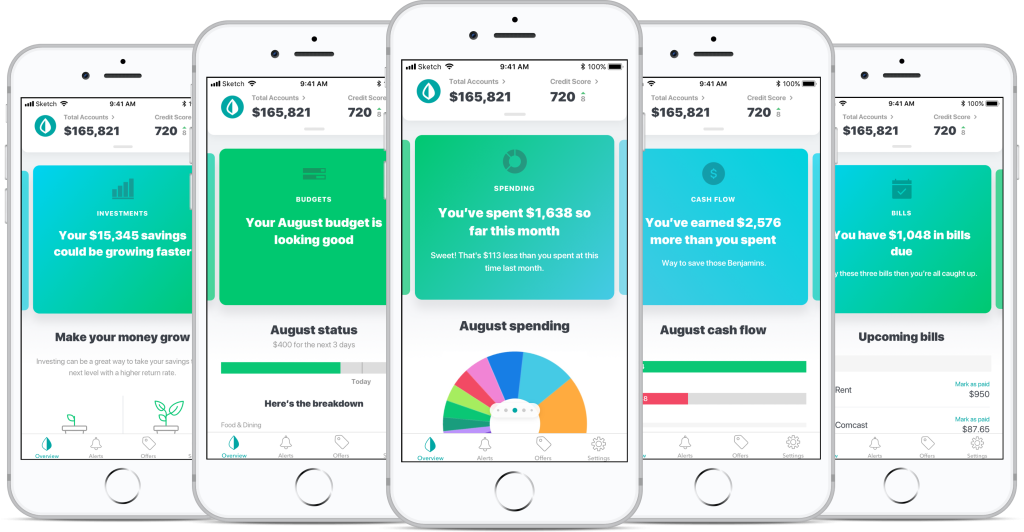

3. Monarch Money

Monarch Money is praised for its modern interface and collaborative budgeting tools. It’s among the best budgeting apps for families and couples who want to manage finances together.

Highlights:

Shared budgeting features

Net worth tracking

Investment integrations

Clean user dashboard

A comprehensive financial planning tool is crucial for anyone serious about building long-term wealth and achieving financial goals. With features like a digital budget calendar, users can schedule expenses, track due dates, and stay organized throughout the month. Using a smart money app allows you to automate your budgeting process, gain real-time insights, and make smarter financial choices with minimal effort.

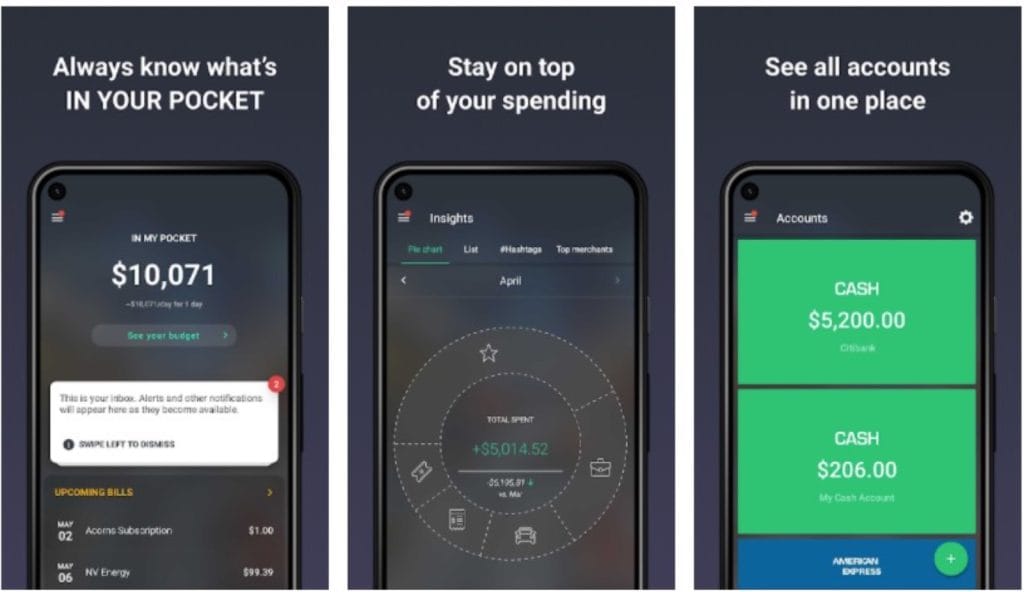

4. PocketGuard

PocketGuard is ideal for users seeking simplicity. Its “In My Pocket” feature shows how much you can spend after accounting for bills, goals, and savings.

Highlights:

Spendable income display

Bill negotiation services

Budget automation

Safe-to-spend calculator

Managing your finances effectively starts with consistent daily habits, and that’s exactly where a daily budget app proves invaluable. Unlike traditional spreadsheets or manual tracking methods, a well-designed income expense tracker gives you a real-time overview of your cash flow, helping you identify spending leaks and optimize your budget.

With the assistance of a smart budgeting assistant, you gain personalized insights, automatic categorization, and reminders that keep your financial goals on track without overwhelming you. Whether you’re living paycheck to paycheck or planning for long-term savings, these intelligent tools adapt to your lifestyle and empower you to make confident financial decisions every single day.

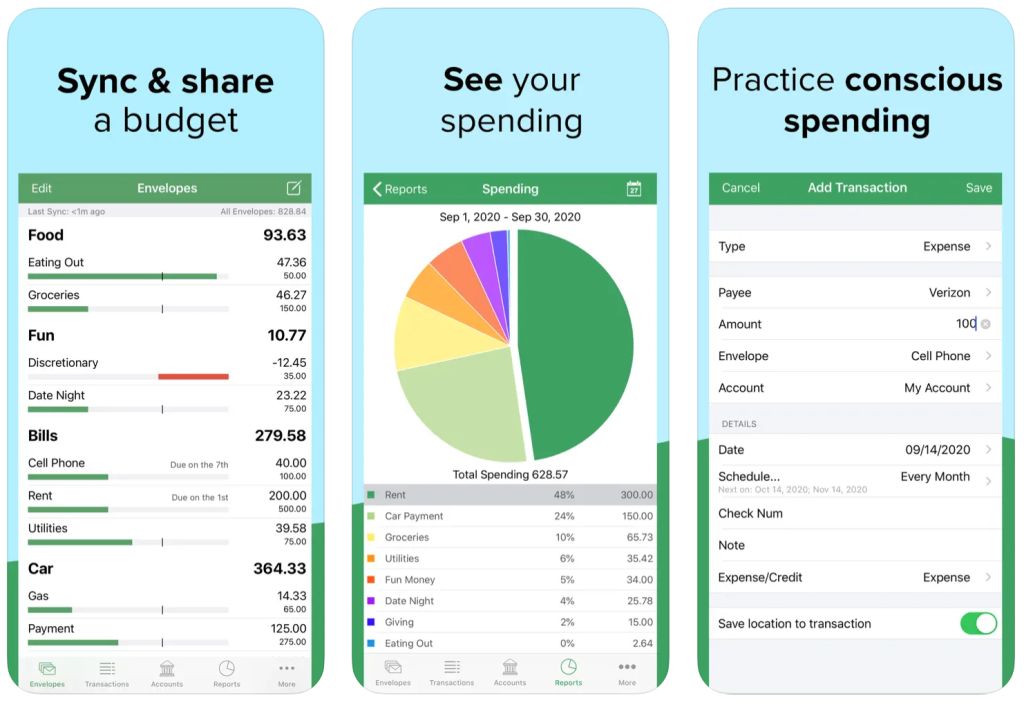

5. Goodbudget

Goodbudget applies the envelope budgeting method in a digital format. It is suitable for those who prefer manual entry and conscious spending.

Highlights:

Envelope-based system

Syncs with multiple devices

Debt payoff support

Educational resources

For those who value structure and control in money management, a digital envelope system offers the perfect blend of tradition and technology. Inspired by the classic cash envelope budgeting method, this modern approach allows you to allocate virtual envelopes for specific spending categories such as groceries, utilities, or entertainment.

By using an intuitive expense planning app, you can track where every dollar goes, set spending limits in advance, and avoid overspending with clear visual cues.

This system not only promotes disciplined budgeting but also builds awareness around spending habits, making it an excellent choice for individuals and families aiming for financial stability and mindful money use.

6. Simplifi by Quicken

Simplifi is a sleek financial management tool by Quicken. Its minimalist design appeals to those who want clarity and control over daily cash flow.

Highlights:

Real-time spend tracking

Customizable spending plans

Personalized insights

Syncs with all financial institutions

In 2025, choosing the right personal finance software can significantly improve the way you manage your money. A streamlined budget app focuses on simplicity and ease of use, helping you organize your finances without the complexity found in outdated tools.

For users seeking a modern Quicken alternative, there are now sleek, cloud-based solutions that offer real-time syncing, intuitive dashboards, and powerful budgeting features — all without the clutter. These new tools empower you to stay on top of your financial life, whether you’re tracking daily expenses or planning for long-term goals, making budgeting a seamless and efficient experience.

7. EveryDollar

EveryDollar, built around the zero-based budgeting method, is especially popular among users who follow Dave Ramsey’s financial principles.

Highlights:

Easy-to-use monthly budget planner

Manual and automated expense tracking

Progress tracking toward financial goals

Free and premium versions

Achieving financial freedom starts with the right tools, and a debt-free budgeting app can be a game changer for anyone working to eliminate debt and build a stable future. Unlike generic platforms, a well-designed personal budget app helps you allocate your income wisely, prioritize debt repayment, and avoid unnecessary spending. With features like a smart monthly planner, you can break down your financial goals into manageable steps, set due dates for bills, and visualize your progress over time. This combination of structure and automation makes it easier to stay committed, develop healthy money habits, and ultimately reach a debt-free lifestyle with confidence.

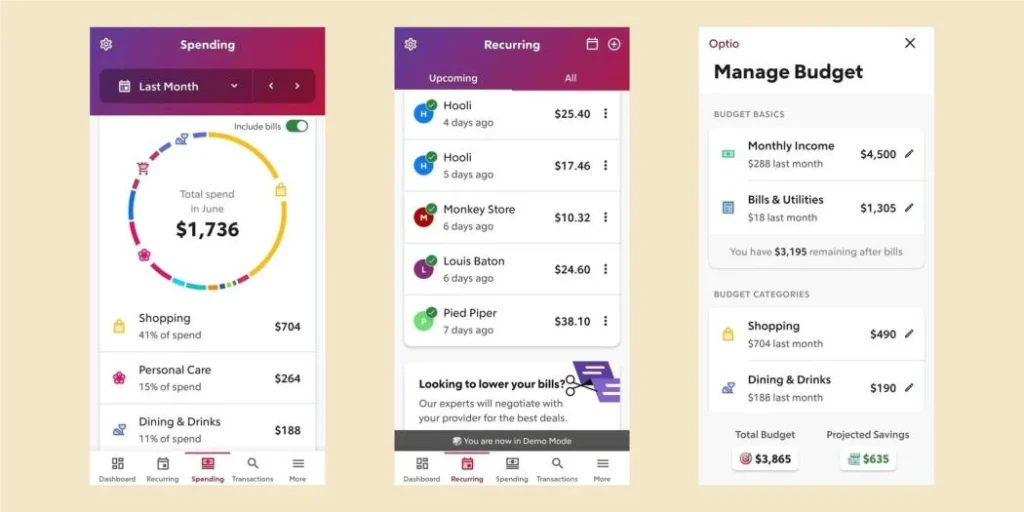

8. Rocket Money (formerly Truebill)

Rocket Money shines as one of the best budgeting apps for subscription management. It helps users detect recurring charges and cancel unwanted services.

Highlights:

Automated subscription tracking

Personalized budgeting dashboard

Bill negotiation service

Savings goal tools

Keeping your finances under control often starts with identifying hidden costs, and that’s where a money-saving app becomes incredibly valuable. Many users are surprised to discover just how much they’re spending on unused or forgotten services.

With built-in subscription cancellation features, these apps make it easy to review, manage, and eliminate recurring charges with just a few taps.

A powerful recurring expense tracker also ensures you stay informed about monthly commitments, helping you avoid budget leaks and redirect your money toward more meaningful goals.

In 2025, these intelligent tools are essential for maximizing savings and minimizing waste in your personal finances.

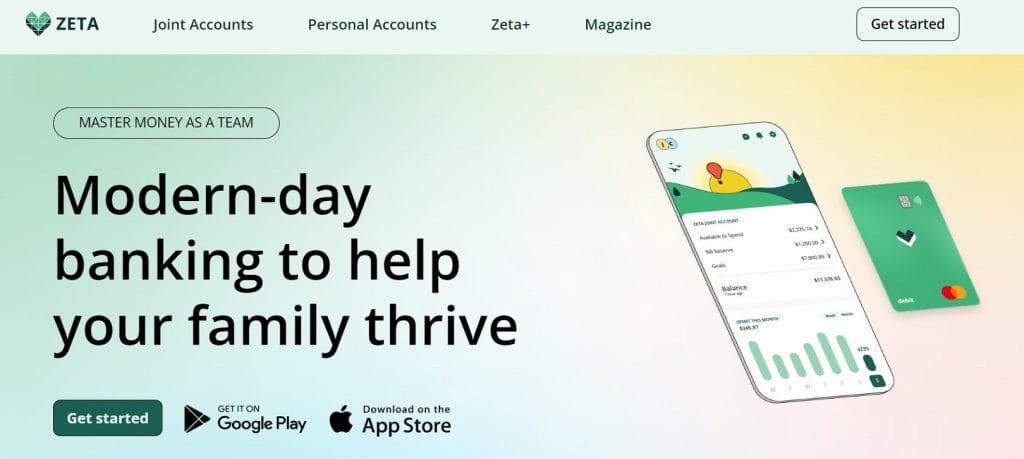

9. Zeta Money Manager

Zeta is tailored for couples and families. It helps partners manage shared budgets, joint accounts, and collective financial goals.

Highlights:

Shared financial planning

Split transaction tracking

Real-time notifications

Goal-focused design

Managing money as a team requires clarity, transparency, and the right tools — and that’s where a couple budgeting tool makes a real difference. Whether you’re sharing expenses, saving for a big purchase, or planning a future together, a reliable financial collaboration app helps both partners stay on the same page.

With features like bill-splitting, shared goals, and real-time notifications, a shared money manager allows couples to track income, spending, and savings seamlessly.

These tools not only reduce misunderstandings about money but also strengthen trust by promoting open, organized financial communication between partners.

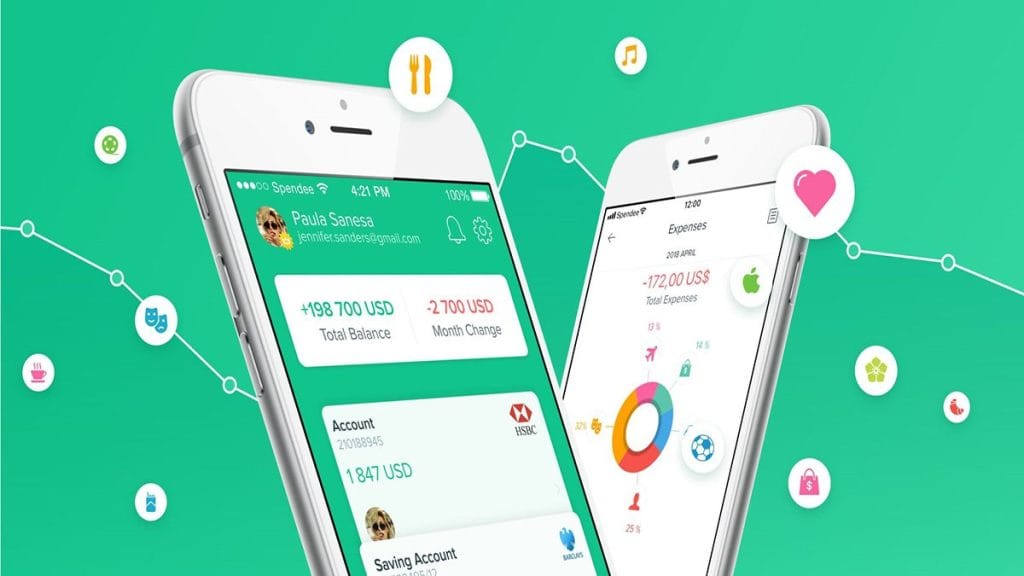

10. Spendee

Spendee features vibrant visualizations and supports both manual and automatic input, making it a favorite among global users.

Highlights:

Multi-currency support

Group budgeting

Spending analysis charts

Color-coded budget categories

For those who prefer a clear and intuitive approach to money management, a visual budgeting app offers powerful insights through easy-to-read charts and graphs.

This type of app transforms complex financial data into a format that’s both accessible and engaging. When managing shared finances, a group finance tracker is especially useful for families, roommates, or teams, allowing everyone involved to stay updated on spending and contributions.

Paired with an effective expense overview tool, users can quickly see where money is going, compare monthly trends, and make informed decisions. Together, these features promote transparency, accountability, and smarter budgeting for both individuals and groups.

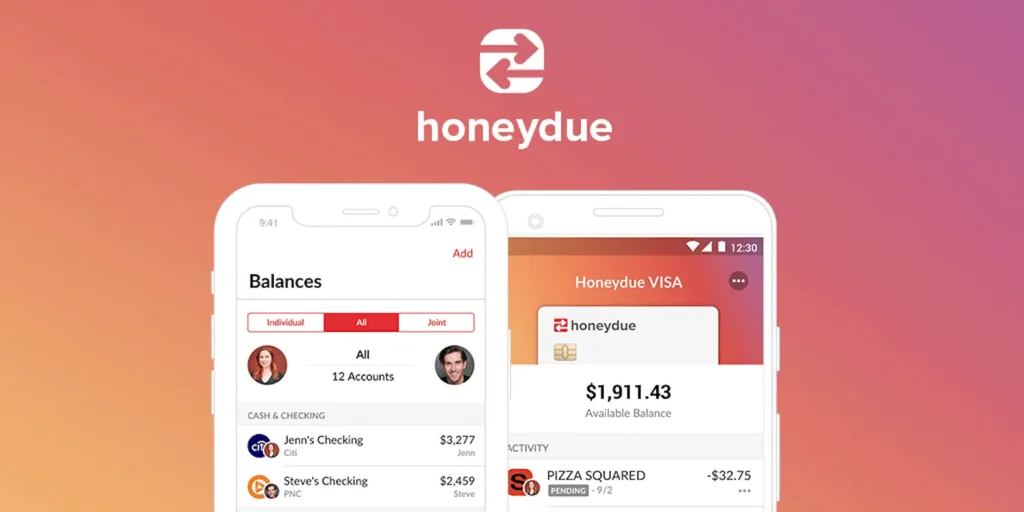

11. Honeydue

Honeydue is ideal for couples who want to budget together while maintaining separate accounts.

Highlights:

Customizable category alerts

Bill reminders

Flexible privacy settings

No shared bank requirement

Building a strong financial foundation is essential in any partnership, and a relationship budgeting app is designed to support exactly that.

These apps provide tools that promote open communication and shared financial planning, making it easier for couples to align their spending, saving, and debt repayment strategies.

A true financial harmony tool goes beyond basic tracking — it enables partners to set mutual goals, receive real-time updates, and avoid financial misunderstandings. With seamless money management for couples, both individuals can contribute to a joint vision while maintaining clarity over personal and shared expenses, leading to better cooperation and long-term stability.

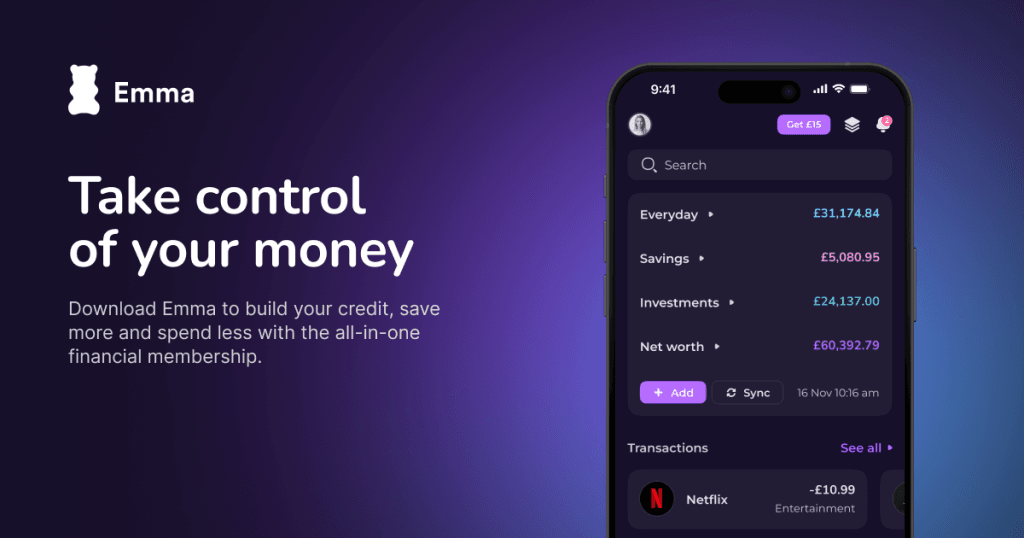

12. Emma

Emma is marketed as a financial advocate in your pocket. It aggregates financial data across platforms and delivers actionable insights.

Highlights:

Subscription tracking

Cashback rewards

Spending analysis

Personalized recommendations

In 2025, managing your finances is smarter and faster with the help of a digital money assistant. These advanced tools act like a virtual financial advisor, offering insights and guidance tailored to your habits and goals. A powerful AI budgeting app can automatically categorize transactions, forecast future spending, and suggest adjustments to improve your financial health. With detailed personal expense analytics, you gain a clear breakdown of where your money is going and how your behavior trends over time. This intelligent approach not only saves time but also empowers you to make proactive decisions and optimize every dollar with confidence.

Categories of Budgeting Apps in 2025

Zero-Based Budgeting Tools

Apps like YNAB and EveryDollar focus on assigning every dollar to a category. These are perfect for users who want total control over their finances.

If you want total control over your money, adopting a budget zero balance approach is one of the most effective strategies available. By assigning every dollar a purpose, you eliminate guesswork and ensure that your income is working exactly how you intend. An advanced personal finance app makes this process seamless, helping you track income, plan expenses, and adjust goals in real time. With a robust zero-based spending tool, you can build a monthly plan where every dollar is accounted for — from fixed bills to savings targets — promoting discipline, clarity, and smarter financial decisions.

AI-Powered Smart Budgeting

Apps such as Emma, Monarch Money, and Simplifi use artificial intelligence to deliver personalized recommendations.

Modern money management demands smarter tools, and an intelligent financial planner is exactly what today’s users need to stay ahead. By leveraging technology, these platforms go beyond manual tracking and offer data-driven budgeting that adjusts to your financial behavior in real time. From identifying overspending patterns to highlighting savings opportunities, they provide actionable guidance tailored to your lifestyle. With automated money insights, you receive instant summaries, alerts, and personalized tips without lifting a finger — making financial planning faster, more accurate, and easier to maintain than ever before.

Collaborative Budgeting Apps

For couples and families, apps like Zeta and Honeydue provide shared dashboards and joint financial tracking.

When two people share financial responsibilities, a dual budgeting app becomes an essential tool for staying organized and aligned.

Designed specifically for couples or partners, these apps help manage money for two by allowing both users to track expenses, set shared goals, and monitor savings together.

A capable joint finance manager simplifies everything from bill splitting to monthly budgeting, ensuring that each person has full visibility and control over their financial contributions.

This collaborative approach strengthens communication, prevents misunderstandings, and builds a more unified financial future.

Free Budgeting Apps

Many of the best budgeting apps in 2025 are available for free with optional premium features. Examples include Mint, PocketGuard, and Goodbudget.

For users looking to take control of their finances without spending extra money, a free financial app is the perfect starting point.

These tools provide powerful features like expense tracking, goal setting, and financial reports — all at no charge. With access to no-cost budget software, users can enjoy many of the same benefits as premium tools, such as account syncing and spending insights, without the added cost.

Choosing to budget without fees means you can focus on improving your financial health without worrying about monthly subscriptions or hidden charges, making smart money management accessible to everyone.

Benefits of Using the Best Budgeting Apps

Real-Time Awareness

Budgeting apps offer real-time insights into your spending patterns, helping you avoid overspending.

Goal-Oriented Planning

Set and track goals such as emergency funds, travel savings, or debt payoff milestones with ease.

Simplified Expense Tracking

With automated categorization, it’s easy to identify where your money goes each month.

Financial Accountability

Apps encourage responsibility through alerts, reminders, and custom insights.

Reduced Financial Stress

By gaining control over finances, users experience improved financial health and peace of mind.

Choosing the Best Budgeting App for You

When selecting from the best budgeting apps in 2025, consider:

Your preferred budgeting method (zero-based, envelope, goal-based)

Whether you prefer automation or manual entry

Device compatibility and interface design

Features such as bill tracking, subscription management, and investment monitoring

Free versus paid features and pricing models

Trends in Budgeting Apps in 2025

AI and Predictive Budgeting

Machine learning and AI help anticipate spending trends, flag potential overspending, and offer proactive solutions.

Crypto Integration

Some budgeting apps now allow users to track cryptocurrency wallets and digital assets.

ESG and Green Budgeting

Apps are starting to show users the environmental impact of their spending choices.

Embedded Financial Education

More apps now include micro-courses, spending challenges, and budgeting templates within the platform.

Security in Budgeting Apps

Security is non-negotiable. The best budgeting apps in 2025 implement:

AES-256 encryption

Bank-grade data protection

Biometric login

Secure API connections

Always review the app’s security protocols before connecting financial accounts.

Future of Budgeting Apps

Looking ahead, we expect further advancements in:

Behavioral budgeting models

Voice-based financial interaction

Financial health scores

Global currency and tax integration

The best budgeting apps will continue to evolve alongside users’ needs, helping people take charge of their financial lives in smarter and more efficient ways.

Conclusion

The best budgeting apps in 2025 provide powerful features to track spending, set goals, and manage money effortlessly. With user-focused design, AI capabilities, and robust security, these tools empower individuals and families to take control of their financial futures. Whether you prefer a traditional envelope system or a high-tech smart assistant, there’s a budgeting app to match your style.

Explore the top budgeting solutions listed in this guide and start building healthier financial habits today.